Catastrophe at Silicon Valley Bank

- alejelab

- Mar 14, 2023

- 1 min read

By: Abdullah Al-Ejel

Silicon Valley Bank, famous for banking with tech startups and small businesses, collapsed as investors scrambled to reclaim their deposits. Notable companies cooped up in this incident include Roblox, Roku, and Circle, with up to billions of dollars thrown into jeopardy.

Why did this happen?

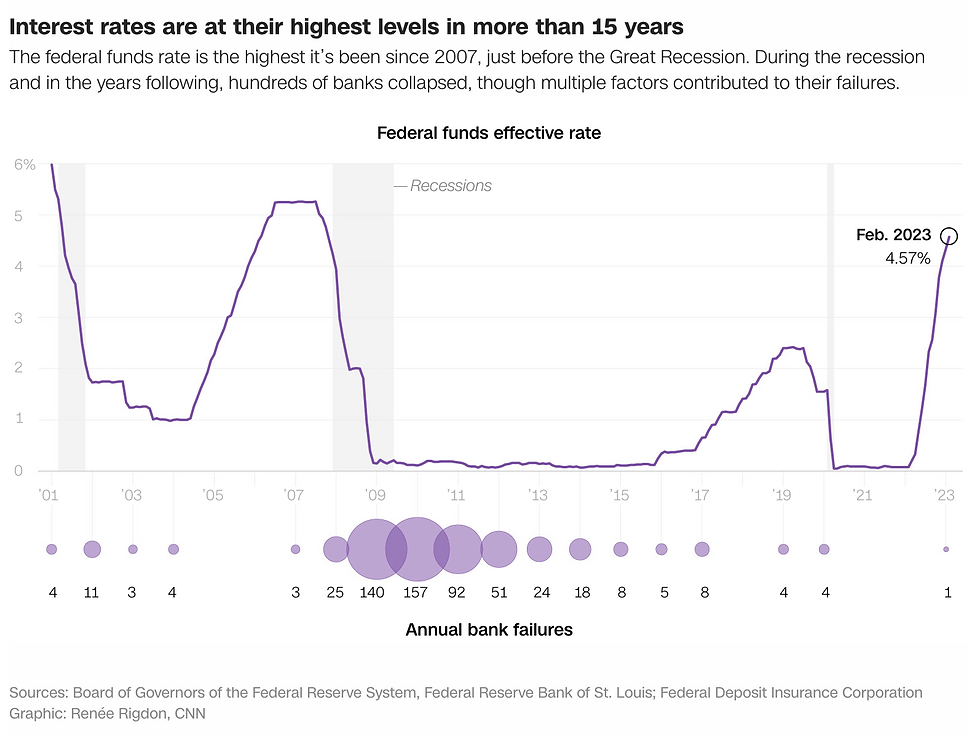

Silicon Valley Bank’s portfolio was “yielding an average 1.79% return last week, far below the 10-year Treasury yield of around 3.9%” (CNN). As interest rates increase and investments return lower average yields, the bank could not maintain a proper balance sheet and sold securities at a loss.

SVB received negative reactions after announcing a negative cash balance and looking for assistance to recoup their capital. Fearing an imminent financial crisis, confidence in the bank dwindled and panic ensued.

A “bank run” began, with over $42 billion in deposit withdrawals made, depleting the banks’ cash and inevitably causing the largest bank collapse since 2008. The failure raises concern about the safety and reliability of similar large banks holding similar capital and cash amounts. Since average Americans do not typically hold many accounts surpassing the $250,000 limit insured by the FDIC, a bank failure will instantly translate over to all money lost. However, businesses commonly exceed this limit, knowingly taking on a risk. The collapse of SVB will be a monumental moment in history, furthering discussion on the handling of banks and possibly federal government policy changes.

Sources/Read Further:

Comments